O Explain the Difference Between Traditional and Enterprise Risk Management

A product that fails too often or in an unsafe manner may require repair replacement or a recall. The uncertainty concerning the future performance of a product or system is a risk to the customer and supplying organization.

Traditional Vs Enterprise Risk Management How Do They Differ

Lets take a look at some basics.

. For instance traditional risk management is more localized and. How enterprise risk management ERM and operational risk management work together to drive performance Subject As federal agencies continue to mature their ERM programs many are asking how risk management at the enterprise-level relates to risk management at the program function or operation unit levels. Traditional risk management occurs within a singular business unit it is departmentalized or occurs in whats called a silo or stove pipe.

And so people start to lose sight of what each of these particular fields is. For instance traditional risk management. The differences between traditional risk management and enterprise risk management are their strategic applications and performance metrics.

Little or no knowledge of overall organizational risks. Explain key drivers of value driven enterprise risk management. In as much as they both try to minimize the effects of risk on a business through identification and analysis they do so from a different view.

Businesses understand they cannot exist in a risk-free environment. But there are important differences between the two. Solution for What are the differences between traditional and enterprise risk management.

Explain why enterprise risk management is a more effective approach for todays organizations. The IT Director or Chief Technology Officer focuses on. How to manage the risks they face depends on many variables including the industry the business.

The two processes are quite similar with the a-one-of-scope difference between them. Write a 1050- to 1400-word paper about enterprise risk management ERM in which you. Explain key drivers of value-driven enterprise risk management.

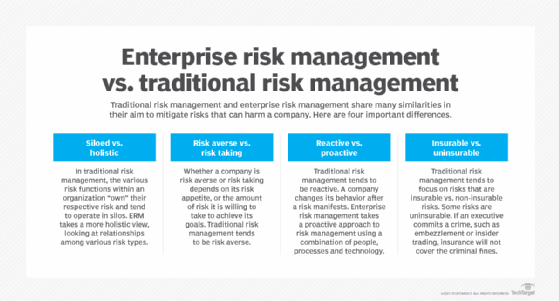

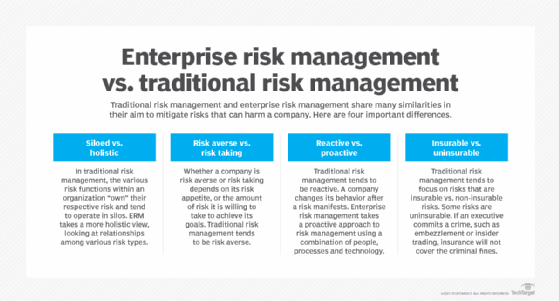

Explain why enterprise risk management is a more effective approach for todays organizations. Both ERM and TRM are methods of making implementing and monitoring decisions that minimize the adverse effects of risk on an organization and they both utilize the six steps of the Risk Management Process. Insurance versus non insurance-In a traditional risk management framework an organization only looks at things that are insurable.

Traditional Risk Management. Traditional risk management deals with risks that are insurable such as accidents while enterprise risk management deals with both insurable risks and any other risk that might occur in an organization and no money can put right for example when an organization is not able to hit it s set goals there s no possibility for them to file a claim with an insurance company Kumar. The difference between the traditional and enterprise risk management include.

Ad Learn Why Top Businesses Trust EY for Risk Management Strategy and Solutions. For example if youre a database. Traditional Risk Management The Same.

Generally people get these confused Risks overlay that are interconnected. There is not much difference between traditional risk management and ERM. Each departmentbusiness unitsilo deals with own risk.

Both ERM and TRM are methods of making implementing and monitoring decisions that minimize the adverse effects of risk on an organization and they both utilize the six steps. Enterprise risk management involves the whole. Figure 2 Currently Unknown But Knowable Risks Overlooked by Traditional Risk Management.

Broad perspective on overall organizational risks. Explain how these key drivers are applied within health care to drive enterprise risk management. Enterprise Risk Management Vs.

Enterprise risk management ERM focuses on the process of planning organizing leading and controlling the activities within your organization. Over the last decade or so a number of business leaders have recognized these potential risk management shortcomings and have begun to embrace the concept of enterprise risk. In as much as they both try to minimize the effects of risk on a business through identification and analysis they do so from a different view.

Explain the difference between traditional and enterprise risk management. Learn What EY Can Do For You. Identify risk within your organization.

Or more to the point the differences between these three. A products performance including its reliability performance reflects. How does traditional risk management differ from enterprise risk management.

ERM works as an organizational review. Emanates from the top typically the Board of Directors. Enterprise Risk Management one would think its all risk management because its the enterprise that you have to manage the risks.

Traditional risk management and enterprise risk management are similar in their aim to mitigate risks that can harm a company. Corporate Risk Management Strategies and Services from EY. One of my most popular articles discusses the differences between traditional risk management and ERM with one of the core differences being the approach to risk.

You look at your strategic business goals and then review the information technology IT risks associated with them. When it comes to identifying and managing the risks of your business there are two ways to go about doing so. In this guide we will be discussing the differences between traditional and enterprise.

There is not much difference between traditional risk management and ERM. The Difference Between Risk Management and Enterprise Risk Management. Explain the difference between traditional and enterprise risk management.

Enterprise Risk Management ERM and Traditional Risk Management TRM share many similarities. These are traditional risk management and enterprise risk managementWhile similar in concept there are some significant yet subtle differences between the two. Effective Enterprise Risk Management ERM Should be a Valued Strategic Tool.

Enterprise Risk Management ERM and Traditional Risk Management TRM share many similarities. Realistically no single group or person in the company has a grasp of the exposure. The two processes are quite similar with the a-one-of-scope difference between them.

Include at least 3 outside sources.

Traditional Vs Enterprise Risk Management Cowell James Forge

Traditional Risk Management Vs Enterprise Risk Management Which Approach Is The Best Choice For Your Company Lowndes Jdsupra

.PNG)

Traditional Risk Management Vs Enterprise Risk Management Which Approach Is The Best Choice For Your Company Lowndes Jdsupra

Comments

Post a Comment